Wind

Heather Broman

Energy Storage

Accure Battery Intelligence

Wind

Dr. Sandeep Gupta

Clearloop, a Silicon Ranch company and leading provider of carbon solutions that accelerate decarbonization of the electric grid and expand renewable energy access in American communities that can benefit the most, announced that Intuit Inc., the global financial technology platform, and national specialty outdoor retailer REI Co-op, flipped the switch on the new 2.8 MWDC White Pine Solar Farm in White Pine, Tennessee.

Intuit and REI each supported the development of 1.4 MWDC of the solar project through Clearloop’s unique and innovative approach to helping organizations reclaim their carbon footprint. This combined effort is estimated to prevent more than 162 million pounds of carbon from entering the atmosphere over the project's lifetime and will produce enough low-cost electricity to help power nearly 400 homes in the local community. In addition to Intuit and REI’s support, the solar project is made possible by the Tennessee Valley Authority’s Dispersed Power Program and the cooperation of local power companies including Morristown Utility Systems.

Since 2021, Intuit has worked with Clearloop to decarbonize the grid while expanding access to renewable energy across Tennessee. Intuit’s support of the White Pine Solar Farm builds upon its ongoing partnership with Clearloop and ongoing efforts for its Prosperity Hub Programin Morristown, TN and the surrounding areas. Intuit launched the Prosperity Hub Program in 2016 to promote economic prosperity for people and communities in need.

To further support the surrounding communities, Intuit is donating 1,600 renewable energy certificates (RECs) per year for the next 40 years evenly across the Jefferson County and Hamblen County schools, making these among the first communities to specifically power local public schools with renewable energy in Tennessee, and among the first green-powered schools in the Southeast. As part of the unique collaboration with Intuit and the local school systems, Clearloop is making a one-time $100,000 scholarship donation ($50,000 per school system) for high school seniors in the Jefferson and Hamblen County, Tennessee school systems.

"Intuit has long been focused on making a positive impact on climate, a significant issue that directly affects the wellbeing and ability of people and communities to prosper. We take a holistic approach to climate and sustainability, driving initiatives internally within our operational footprint, supply chain, and externally in the communities we serve," said Debbie Lizt, Head of Global Sustainability at Intuit. "Our collaboration with Clearloop and the local community allows us to bring a meaningful and intentional focus to new solar projects in areas where we can provide environmental and economic benefits to the communities for years to come."

REI’s partnership with Clearloop to help bring the White Pine Solar Farm to life demonstrates the company’s commitment to prioritizing clean energy development that focuses on investing in communities that can benefit the most. Through this partnership, REI will power its new state-of-the-art distribution center in Lebanon, Tennessee with 100% renewable energy. The distribution center will serve more than 60 stores and 5.6 million REI members in the area while using 30% less energy than code requires.

“The White Pine project represents an exciting addition to REI's renewable energy portfolio. We're proud to help usher in new-to-the-world solar energy in the Tennessee Valley, a region where we recently opened a new distribution center, operate multiple stores, and have thousands of members,” said Matt Thurston, Divisional Vice President of Sustainability, REI Co-op. “Clearloop's vision to decarbonize the grid by supporting projects that expand access to clean energy in more communities—along with the project's investments in the local workforce and regenerative land practices—is one in which we strongly believe.”

“Clearloop's partnerships with Intuit, REI, and the local community help us realize our commitment to decarbonizing the grid with an intentional focus on commissioning new solar projects in communities where we can maximize the environmental, educational, and economic benefits of climate dollars,” said Laura Zapata, CEO and Co-Founder, Clearloop. “This project represents the possibilities fostered by responsible, thoughtful, and meaningful corporate climate action. We look forward to continuing to build on our relationships with corporate leaders and communities alike to deliver on the promise of a transformational and inclusive energy transition.”

As is the case with all Clearloop projects, the White Pine Solar Farm will be developed, owned, and operated by its parent Silicon Ranch for the lifetime of the project. Through this disciplined and community-focused approach, Clearloop will maintain a long-term vested interest in the East Tennessee region. The White Pine solar project’s energy output and the carbon it avoids are tracked live on Clearloop’s website here.

Clearloop | clearloop.us

America’s offshore wind energy supply chain is marking a major milestone, with the christening of the first-ever American-built, owned, and crewed offshore wind service operations vessel (SOV), which will play a key role in enabling domestic energy production and strengthening America’s energy independence.

U.S. House Majority Leader Steve Scalise (LA-01) and U.S. Congressman Troy A. Carter, Sr. (LA-02) joined senior executives from American offshore wind leader Ørsted and Louisiana-based vessel builder Edison Chouest Offshore (ECO) at events in Louisiana this weekend to celebrate the completion of the SOV, the ECO EDISON.

The ECO EDISON, officially christened Saturday at the Port of New Orleans by Jennifer Scalise, is the first U.S.-flagged offshore wind SOV. An example of the major financial investments into U.S. ports, maritime activities, manufacturing, workforce and domestic energy by Ørsted, the vessel will play an integral part of the operation and maintenance of Ørsted and Eversource’s South Fork Wind, Revolution Wind and Sunrise Wind projects.

The ECO EDISON, officially christened Saturday at the Port of New Orleans by Jennifer Scalise, is the first U.S.-flagged offshore wind SOV. An example of the major financial investments into U.S. ports, maritime activities, manufacturing, workforce and domestic energy by Ørsted, the vessel will play an integral part of the operation and maintenance of Ørsted and Eversource’s South Fork Wind, Revolution Wind and Sunrise Wind projects.

Ørsted’s investment in the ECO EDISON is a testament to the company’s commitment to building a new domestic offshore energy supply chain. The ECO EDISON was built by more than 600 workers – across nearly 1 million work hours – at ECO in-house shipyards in Louisiana, Mississippi and Florida, with components of the vessel sourced from 34 states, from Alabama to West Virginia.

Ørsted’s projects are creating jobs and driving economic development across dozens of states, with the Gulf of Mexico region playing a central role. Several Gulf Coast companies are putting their vast experience from other ocean-based industries to work in this new energy sector, including companies like ECO, which has deep expertise in offshore energy.

The state-of-the-art, 262-foot long liveaboard ECO EDISON will serve as a floating, year-round homebase for 60 of the first American offshore wind turbine technicians, who will work at-sea over the life of the wind farms, servicing and maintaining the wind turbines.

“The Gulf Coast region is playing a huge role in the growing U.S. offshore wind supply chain, using their decades of experience to deliver more homegrown American energy and serving as one example of Ørsted’s more than $20 billion of investments into the United States,” said David Hardy, Group EVP and CEO Americas at Ørsted. “Thank you to Edison Chouest for delivering this milestone – building the first American-made service operations vessel. Our team can’t wait to put her in service, with state-of-the-art safety technologies and features to ensure comfort at sea. We’re grateful to Leader Scalise and his wife, Jennifer, and Congressman Carter for joining the festivities this weekend to ready the ECO EDISON for her work advancing American energy.”

“We’re incredibly proud that our shipyards, engineers and more than 600 shipbuilders have now delivered a U.S.-first vessel that will support offshore wind energy for years to come for our trusted partners at Ørsted,” said Mr. Gary Chouest, President of Edison Chouest Offshore. “Just as several of our vessels supported the construction of the first utility-scale offshore wind farm, South Fork Wind Farm, so too will the ECO EDISON lead the way as this first-ever American-made offshore wind SOV.”

The ECO EDISON will be powered by two Cat® 3512E engines from key supplier, Houston-based Caterpillar Marine, underscoring the vast opportunity offshore wind offers existing American manufacturers and shipyards.

“Caterpillar Marine is committed to helping our customers reach their most challenging goals and is proud to provide the power for this first American-built offshore wind SOV. The U.S. EPA Tier 4 certified Cat 3512E engines are built with the highest durability and are ready to be dual-fuel methanol converted in the future, ensuring that Ørsted can always meet their needs, both today and long into the future," said Brad Johnson, Vice President and General Manager of Caterpillar Marine.

The ECO EDISON’s special-purpose design is focused on passenger safety and comfort, enhanced maneuverability, extended offshore endurance and reduced emissions. It includes special features like a “walk to work” motion-compensated gangway that allows technicians to easily and safely access the wind turbines. A smaller, so-called “daughter” craft onboard can be deployed to efficiently maneuver crew across the wind farms.

Ørsted | us.orsted.com

BrightNight, the next generation global renewable power producer built to deliver clean and dispatchable solutions, and its joint venture partner Cordelio Power, announced they have secured a US$414 million construction credit facility for their Box Canyon utility-scale solar power project in Pinal County, Arizona. BrightNight and Cordelio are co-members of BOCA bn, LLC, the owner of the Box Canyon project. Construction of this 300MW project began in December 2023 and is expected to begin operation in 1H in 2025.

Zions Bancorporation served as the Administrative Agent and Coordinating Lead Arranger. The Joint Lead Arrangers are National Bank of Canada, Royal Bank of Canada, Sumitomo Mitsui Trust Bank, and Canadian Imperial Bank of Commerce.

BrightNight advised BOCA on the 20-year power purchase agreement (PPA) that BOCA entered into with the Southwest Public Power Agency (SPPA) in December of 2022. The project represents the largest renewable energy procurement in SPPA's history, and a major step in Arizona's clean energy transformation. The project is the first in the 2 GW Arizona portfolio owned by BrightNight and Cordelio Power to commence construction. BrightNight is leading the development of the Box Canyon project as part of its joint venture with Cordelio Power.

Part of BrightNight's industry-leading 37GW renewable power portfolio, the Box Canyon solar project will produce enough electricity to power 77,000 Arizona homes and businesses annually with clean, reliable, and affordable energy, offsetting ~600 metric tons of CO2 emissions every hour. The project features a design optimized to maximize performance and deliver the highest-value project at the lowest cost with the help of PowerAlpha®, BrightNight's revolutionary artificial Intelligence platform. The Box Canyon Solar Project is an integral part of BrightNight's broader vision for Arizona that includes a 2 GW portfolio with 900 MW in advanced stages across three counties, slated to create over 800 local skilled jobs and generate hundreds of millions of dollars in tax revenue for the state and local municipalities. Blattner is the project's engineering, procurement, and construction (EPC) contractor.

BrightNight CEO Martin Hermann said, "Along with our recent $375 million corporate credit facility with a strong bank group, this successful financing is a significant milestone in funding the buildout of our extensive 37 GW renewable power portfolio. We deeply value our partnership with SPPA, Pinal County and the state of Arizona. This funding will bring much-needed clean power, hundreds of skilled jobs, economic development and energy security to this strategic and rapidly growing region."

"A critical part of being a next generation IPP and building out our portfolio is securing the right capital to deliver on our ambitious plans," said BrightNight's CFO Brian Boland. "Reaching financial close on a utility-scale project of this magnitude is an extensive undertaking. These transactions are complex, require extensive due diligence and strong partners. I want to thank the BrightNight team, our participating banks, and project partners in supporting us on this project that will benefit SPPA, Arizona, and our investors."

BrightNight | www.brightnightpower.com

CEP Renewables announced that construction has begun on its 19 MW dc grid supply Foul Rift solar project located in White Township, Warren County, New Jersey. The project is being developed on a brownfield, an environmentally impaired site, that had been the home to a composting facility for nearly three decades. Prior to the cessation of operations, the facility had a long history of violations received from New Jersey Department of Environmental Protection (NJDEP). CEP's development of this project will complete the environmental remediation at this site while also providing reliable clean energy, pollinator habitats and greater tax revenue for the local community. This fixed-tilt, bifacial solar module project is expected to reach commercial operation by September 2024.

"This project is the perfect example of the use of the renewable energy subsidy to not only reduce the regional carbon footprint, but also remediate environmental damages that would not have otherwise been addressed," said Chris Ichter, Executive Vice President at CEP Renewables. "We are pleased to have been able to leverage our prior experience on similarly challenging landfill and brownfield solar projects to develop a successful public-private partnership with White Township that will positively impact generations to come."

When CEP first came across this property, it had been contaminated as a result of the composting facility's operations. An extensive environmental investigation indicated that the soils were contaminated with metals including arsenic and polycyclic aromatic hydrocarbons that necessitated the use of an institutional control. In total, the investigation identified ninety-two separate notices of environmental violations from NJDEP. In order to bring the site into compliance with NJDEP, CEP removed the remaining berm of compost and waste materials and worked with NJDEP to successfully resolve the remaining violations and terminate the solid waste permit.

As part of its partnership with White Township, in exchange for certain interconnection easement rights, CEP also agreed to create a porous pavement walking path circulating throughout the Township's recreational fields. This is an improvement that the Township had been planning to build, but which had long remained unfulfilled due to lack of funding. In addition to turning an environmentally hazardous site into a revenue generating asset, the Foul Rift project also contributes to New Jersey maintaining its ranking as the number one U.S. state for installed solar capacity per square mile. This project also further supports the state in achieving its goal of 100 percent clean electricity by 2035 - the most ambitious clean energy goal in the country.

CEP Renewables | https://www.ceprenewables.com/

U.S. Secretary of Energy Jennifer Granholm announced the appointment of USEA Board of Directors Chair, Vicky Bailey, to the inaugural board of the Foundation for Energy Security and Innovation (FESI).

“We at USEA are incredibly proud of Vicky’s appointment to this critical board that will help ensure energy security and prosperity,” USEA President and CEO Mark Menezes said. “I look forward to seeing what she and the rest of the board will do.”

The Foundation for Energy Security and Innovation (FESI), created by the 2022 CHIPS and Science Act, is an independent non-profit that partners with the Department of Energy (DOE). FESI fuels America's progress by accelerating the development and commercialization of clean energy solutions. Through private sector and philanthropic partnerships, they'll provide DOE with extra resources to support research and innovation that strengthens US energy security and environmental goals. This aligns perfectly with the Biden-Harris Administration's clean energy ambitions.

“Joining FESI really comes at a critical point from a policy perspective regarding investment in technology and innovation as we strive to have a transition that is affordable, clean, and secure,” USEA Board of Directors Chair Vicky Bailey said. “My hope for FESI is that we are able to accelerate the commercialization of clean energy technologies that are needed to meet our climate goals and maintain energy security. This is in line with USEA’s mission to promote energy development by expanding access to safe, affordable, sustainable, and environmentally acceptable energy for all in partnership with the U.S. Government.”

More information on FESI may be found here.

USEA | www.usea.org

Height Safety Leader Guardian is proud to support OSHA’s (Occupational Safety and Health Administration) National Safety Stand-Down to Prevent Falls in Construction event being held this week from May 6-10. As the world’s largest independent height safety brand, keeping workers safe at height is core to all we do.

Our team of height safety experts are busy leading Safety Stand-Down events throughout the country this week and throughout May for our valued customers and end-users. These events include Fall Protection Awareness (FPA) training, safety assessments, height safety product knowledge sessions, special events and more.

In support of Safety Stand-Down and our team’s events, Guardian has created a NEW Fall Protection Awareness Resource Page that provides a comprehensive range of 360-degree height safety resources and tools designed to educate, inform, and support organizations and their workers in preventing falls and promoting height safety.

Resource topics include:

Each section contains invaluable tips, tools, links to product pages, videos on these topics and much more!

Click here for more Height Safety Resources.

For a product demonstration or quotation, reach out to your local Guardian height safety expert .

Together, let’s work towards preventing falls in the construction industry and keeping workers safe at height.

Safety Stand-Down/May Promotion: 50% of all Online Training*

*see here for 50% off promotion details

Guardian Fall | guardianfall.com

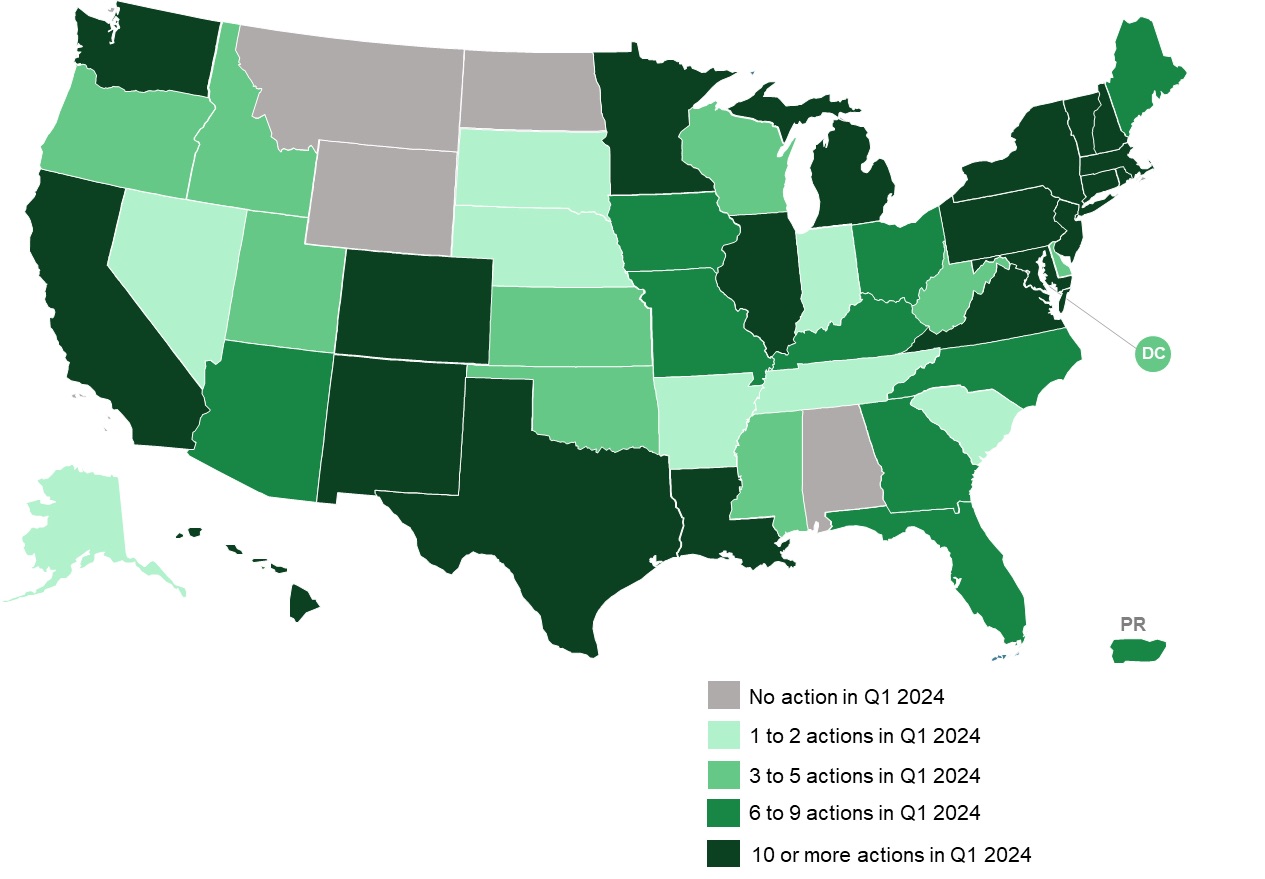

The NC Clean Energy Technology Center (NCCETC) released its Q1 2024 edition of The 50 States of Electric Vehicles. The quarterly series provides insights on state regulatory and legislative discussions and actions on electric vehicles and charging infrastructure.

The report finds that 46 states, plus the District of Columbia and Puerto Rico took actions related to electric vehicles and charging infrastructure during Q1 2024 (see figure below), with the greatest number of actions relating to rebate and grant programs; registration, mileage, or charging fees for electric vehicles; state procurement of electric vehicles; charging infrastructure planning activities; and rules governing publicly available charging stations. States also continued to take actions planning for National Electric Vehicle Infrastructure (NEVI) program funding distribution.

A total of 595 electric vehicle actions were taken during Q1 2024, with the most active states being Massachusetts, New York, California, Illinois, New Jersey, Minnesota, Hawaii and Maryland. So far in 2024, 16 states have enacted legislation related to transportation electrification, as of early May 2024.

Q1 2024 State and Utility Action on Electric Vehicles

The report discusses three trends in electric vehicle actions taken in Q1 2024: (1) states considering pulling back or prohibiting zero-emission vehicle targets, (2) lawmakers pursuing battery recycling requirements, and (3) states and utilities advancing bidirectional charging programs.

"This quarter, lawmakers in several states, including Minnesota, New Mexico, New York, and Washington, considered legislation to repeal previously enacted standards and mandates related to the adoption of EVs,” said Emily Apadula, Policy Analyst at NCCETC. "This follows another recent trend in legislation to restrict or prevent state agencies from adopting vehicle emissions standards and/or EV mandates."

The report notes five of the top policy developments of the quarter:

"Some states are pumping the brakes on EV adoption targets, while other states are examining policies to better integrate this new load,” observed Brian Lips, Senior Project Manager at NCCETC. “Proving that one size does not fit all, states continue experimenting with different approaches to different EV market segments.”

View the 50 States of Electric Vehicles Q1 2024 Quarterly Report Executive Summary

View and Purchase the 50 States of Electric Vehicles Q1 2024 Quarterly Report

View other 50 States Reports – Solar, Grid Modernization, Electric Vehicles and Decarbonization

NC Clean Energy Technology Center | http://www.nccleantech.ncsu.edu

Alternative Energies May 15, 2023

The United States is slow to anger, but relentlessly seeks victory once it enters a struggle, throwing all its resources into the conflict. “When we go to war, we should have a purpose that our people understand and support,” as former Secretary ....

Unleashing trillions of dollars for a resilient energy future is within our grasp — if we can successfully navigate investment risk and project uncertainties.

The money is there — so where are the projects?

A cleaner and more secure energy future will depend on tapping trillions of dollars of capital. The need to mobilize money and markets to enable the energy transition was one of the key findings of one of the largest studies ever conducted among the global energy sector C-suite. This will mean finding ways to reduce the barriers and uncertainties that prevent money from flowing into the projects and technologies that will transform the energy system. It will also mean fostering greater collaboration and alignment among key players in the energy space.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

These risks need to be addressed to create more appealing investment opportunities for both public and private sector funders. This will require smart policy and regulatory frameworks that drive returns from long-term investment into energy infrastructure. It will also require investors to recognize that resilient energy infrastructure is more than an ESG play — it is a smart investment in the context of doing business in the 21st century.

Make de-risking investment profiles a number one priority

According to the study, 80 percent of respondents believe the lack of capital being deployed to accelerate the transition is the primary barrier to building the infrastructure required to improve energy security. At the same time, investors are looking for opportunities to invest in infrastructure that meets ESG and sustainability criteria. This suggests an imbalance between the supply and demand of capital for energy transition projects.

How can we close the gap?

One way is to link investors directly to energy companies. Not only would this enable true collaboration and non-traditional partnerships, but it would change the way project financing is conceived and structured — ultimately aiding in potentially satisfying the risk appetite of latent but hugely influential investors, such as pension funds. The current mismatch of investor appetite and investable projects reveals a need for improving risk profiles, as well as a mindset shift towards how we bring investment and developer stakeholders together for mutual benefit. The circular dilemma remains: one sector is looking for capital to undertake projects within their skill to deploy, while another sector wonders where the investable projects are.

This conflict is being played out around the world; promising project announcements are made, only to be followed by slow progress (or no action at all). This inertia results when risks are compounded and poorly understood. To encourage collaboration between project developers and investors with an ESG focus, more attractive investment opportunities can be created by pulling several levers: public and private investment strategies, green bonds and other sustainable finance instruments, and innovative financing models such as impact investing.

Expedite permitting to speed the adoption of new technologies

Another effective strategy to de-risk investment profiles is found in leveraging new technologies and approaches that reduce costs, increase efficiency, and enhance the reliability of energy supply. Research shows that 62 percent of respondents indicated a moderate or significant increase in investment in new and transitional technologies respectively, highlighting the growing interest in innovative solutions to drive the energy transition forward.

Hydrogen, carbon capture and storage, large-scale energy storage, and smart grids are some of the emerging technologies identified by survey respondents as having the greatest potential to transform the energy system and create new investment opportunities. However, these technologies face challenges such as long lag times between conception and implementation.

If the regulatory environment makes sense, then policy uncertainty is reduced, and the all-important permitting pathways are well understood and can be navigated. Currently, the lack of clear, timely, and fit-for-purpose permitting is a major roadblock to the energy transition. To truly unleash the potential of transitional technologies requires the acceleration of regulatory systems that better respond to the nuance and complexity of such technologies (rather than the current one-size-fits all approach). In addition, permitting processes must also be expedited to dramatically decrease the period between innovation, commercialization, and implementation. One of the key elements of faster permitting is effective consultation with stakeholders and engagement with communities where these projects will be housed for decades. This is a highly complex area that requires both technical and communication skills.

The power of collaboration, consistency, and systems thinking

The report also reveals the need for greater collaboration among companies in the energy space to build a more resilient system. The report shows that, in achieving net zero, there is a near-equal split between those increasing investment (47 percent of respondents), and those decreasing investment (39 percent of respondents). This illustrates the complexity and diversity of the system around the world. A more resilient system will require all its components – goals and actions – to be aligned towards a common outcome.

Another way to de-risk the energy transition is to establish consistent, transparent, and supportive policy frameworks that encourage investment and drive technological innovation. The energy transition depends on policy to guide its direction and speed by affecting how investors feel and how the markets behave. However, inconsistent or inadequate policy can also be a source of uncertainty and instability. For example, shifting political priorities, conflicting international standards, and the lack of market-based mechanisms can hinder the deployment of sustainable technologies, resulting in a reluctance to commit resources to long-term projects.

Variations in country-to-country deployment creates disparities in energy transition progress. For instance, the 2022 Inflation Reduction Act in the US has posed challenges for the rest of the world, by potentially channeling energy transition investment away from other markets and into the US. This highlights the need for a globally unified approach to energy policy that balances various national interests while addressing a global problem.

To facilitate the energy transition, it is imperative to establish stable, cohesive, and forward-looking policies that align with global goals and standards. By harmonizing international standards, and providing clear and consistent signals, governments and policymakers can generate investor confidence, helping to foster a robust energy ecosystem that propels the sector forward.

Furthermore, substantive and far-reaching discussions at international events like the United Nations Conference of the Parties (COP), are essential to facilitate this global alignment. These events provide an opportunity to de-risk the energy transition through consistent policy that enables countries to work together, ensuring that the global community can tackle the challenges and opportunities of the energy transition as a united front.

Keeping net-zero ambitions on track

Despite the challenges faced by the energy sector, the latest research reveals a key positive: 91 percent of energy leaders surveyed are working towards achieving net zero. This demonstrates a strong commitment to the transition and clear recognition of its importance. It also emphasizes the need to accelerate our efforts, streamline processes, and reduce barriers to realizing net-zero ambitions — and further underscores the need to de-risk energy transition investment by removing uncertainties.

The solution is collaborating and harmonizing our goals with the main players in the energy sector across the private and public sectors, while establishing consistent, transparent, and supportive policy frameworks that encourage investment and drive technological innovation.

These tasks, while daunting, are achievable. They require vision, leadership, and action from all stakeholders involved. By adopting a new mindset about how we participate in the energy system and what our obligations are, we can stimulate the rapid progress needed on the road to net zero.

Dr. Tej Gidda (Ph.D., M.Sc., BSc Eng) is an educator and engineer with over 20 years of experience in the energy and environmental fields. As GHD Global Leader – Future Energy, Tej is passionate about moving society along the path towards a future of secure, reliable, and affordable low-carbon energy. His focus is on helping public and private sector clients set and deliver on decarbonization goals in order to achieve long-lasting positive change for customers, communities, and the climate. Tej enjoys fostering the next generation of clean energy champions as an Adjunct Professor at the University of Waterloo Department of Civil and Environmental Engineering.

GHD | www.ghd.com

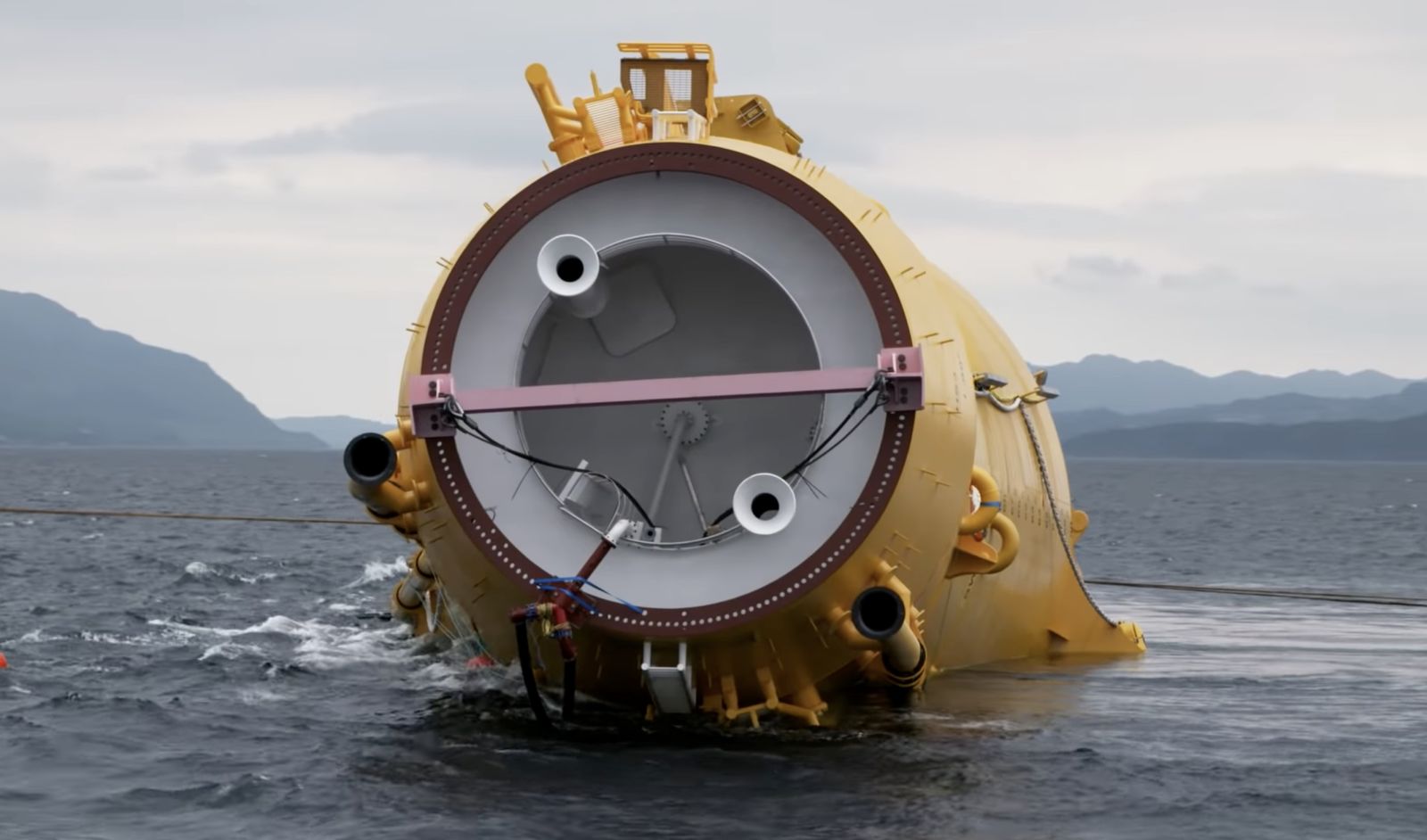

The Kincardine floating wind farm, located off the east coast of Scotland, was a landmark development: the first commercial-scale project of its kind in the UK sector. Therefore, it has been closely watched by the industry throughout its installation. With two of the turbines now having gone through heavy maintenance, it has also provided valuable lessons into the O&M processes of floating wind projects.

In late May, the second floating wind turbine from the five-turbine development arrived in the port of Massvlakte, Rotterdam, for maintenance. An Anchor Handling Tug Supply (AHTS)

vessel was used to deliver the KIN-02 turbine two weeks after a Platform Supply Vessel (PSV) and AHTS had worked to disconnect the turbine from the wind farm site. The towing vessel became the third vessel used in the operation.

This is not the first turbine disconnected from the site and towed for maintenance. In the summer of 2022, KIN-03 became the world’s first-ever floating wind turbine that required heavy maintenance (i.e. being disconnected and towed for repair). It was also towed from Scotland to Massvlakte.

Each of these operations has provided valuable lessons for the ever-watchful industry in how to navigate the complexities of heavy maintenance in floating wind as the market segment grows.

The heavy maintenance process

When one of Kincardine’s five floating 9.5 MW turbines (KIN-03) suffered a technical failure in May 2022, a major technical component needed to be replaced. The heavy maintenance strategy selected by the developer and the offshore contractors consisted in disconnecting and towing the turbine and its floater to Rotterdam for maintenance, followed by a return tow and re-connection. All of the infrastructure, such as crane and tower access, remained at the quay following the construction phase. (Note, the following analysis only covers KIN-03, as details of the second turbine operation are not yet available).

Comparing the net vessel days for both the maintenance and the installation campaigns at this project highlights how using a dedicated marine spread can positively impact operations.

For this first-ever operation, a total of 17.2 net vessel days were required during turbine reconnection—only a slight increase on the 14.6 net vessel days that were required for the first hook-up operation performed during the initial installation in 2021. However, it exceeds the average of eight net vessel days during installation. The marine spread used in the heavy maintenance operation differed from that used during installation. Due to this, it did not benefit from the learning curve and experience gained throughout the initial installation, which ultimately led to the lower average vessel days.

The array cable re-connection operation encountered a similar effect. The process was performed by one AHTS that spent 10 net vessel days on the operation. This compares to the installation campaign, where the array cable second-end pull-in lasted a maximum of 23.7 hours using a cable layer.

Overall, the turbine shutdown duration can be broken up as 14 days at the quay for maintenance, 52 days from turbine disconnection to turbine reconnection, and 94 days from disconnection to the end of post-reconnection activities.

What developers should keep in mind for heavy maintenance operations

This analysis has uncovered two main lessons developers should consider when planning a floating wind project: the need to identify an appropriate O&M port, and to guarantee that a secure fleet is available.

Floating wind O&M operations require a port with both sufficient room and a deep-water quay. The port must also be equipped with a heavy crane with sufficient tip height to accommodate large floaters and reach turbine elevation. Distance to the wind farm should also be taken into account, as shorter distances will reduce towing time and, therefore, minimize transit and non-productive turbine time.

During the heavy maintenance period for KIN-03 and KIN-02, the selected quay (which had also been utilized in the initial installation phase of the wind farm project), was already busy as a marshalling area for other North Sea projects. This complicated the schedule significantly, as the availability of the quay and its facilities had to be navigated alongside these other projects. This highlights the importance of abundant quay availability both for installation (long-term planning) and maintenance that may be needed on short notice.

At the time of the first turbine’s maintenance program (June 2022), the North Sea AHTS market was in an exceptional situation: the largest bollard pull AHTS units contracted at over $200,000 a day, the highest rate in over a decade.

During this time, the spot market was close to selling out due to medium-term commitments, alongside the demand for high bollard pull vessels for the installation phase at a Norwegian floating wind farm project. The Norwegian project required the use of four AHTS above a 200t bollard pull. With spot rates ranging from $63,000 to $210,000 for the vessels contracted for Kincardine’s maintenance, the total cost of the marine spread used in the first repair campaign was more than $4 million.

Developers should therefore consider the need to structure maintenance contracts with AHTS companies, either through frame agreements or long-term charters, to decrease their exposure to spot market day rates as the market tightens in the future.

While these lessons are relevant for floating wind developers now, new players are looking towards alternative heavy O&M maintenance options for the future. Two crane concepts are especially relevant in this instance. The first method is for a crane to be included in the turbine nacelle to be able to directly lift the component which requires repair from the floater, as is currently seen on onshore turbines. This method is already employed in onshore turbines and could be applicable for offshore. The second method is self-elevating cranes with several such solutions already in development.

The heavy maintenance operations conducted on floating turbines at the Kincardine wind farm have provided invaluable insights for industry players, especially developers. The complex process of disconnecting and towing turbines for repairs highlights the need for meticulous planning and exploration of alternative maintenance strategies, some of which are already in the pipeline. As the industry evolves, careful consideration of ports, and securing fleet contracts, will be crucial in driving efficient and cost-effective O&M practices for the floating wind market.

Sarah McLean is Market Research Analyst at Spinergie, a maritime technology company specializing in emission, vessel performance, and operation optimization.

Spinergie | www.spinergie.com

According to the Energy Information Administration (EIA), developers plan to add 54.5 gigawatts (GW) of new utility-scale electric generating capacity to the U.S. power grid in 2023. More than half of this capacity will be solar. Wind power and battery storage are expected to account for roughly 11 percent and 17 percent, respectively.

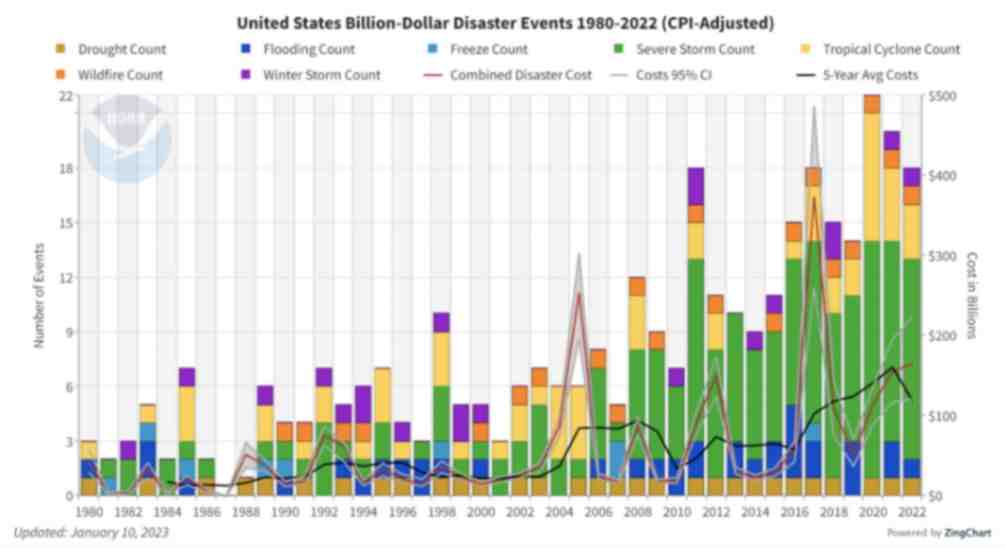

A large percentage of new installations are being developed in areas that are prone to extreme weather events and natural disasters (e.g., Texas and California), including high wind, tornadoes, hail, flooding, earthquakes, wildfires, etc. With the frequency and severity of many of these events increasing, project developers, asset owners, and tax equity partners are under growing pressure to better understand and mitigate risk.

Figure 1. The history of billion-dollar disasters in the United States each year from 1980 to 2022 (source: NOAA)

In terms of loss prevention, a Catastrophe (CAT) Modeling Study is the first step to understanding the exposure and potential financial loss from natural hazards or extreme weather events. CAT studies form the foundation for wider risk management strategies, and have significant implications for insurance costs and coverage.

Despite their importance, developers often view these studies as little more than a formality required for project financing. As a result, they are often conducted late in the development cycle, typically after a site has been selected. However, a strong case can be made for engaging early with an independent third party to perform a more rigorous site-specific technical assessment. Doing so can provide several advantages over traditional assessments conducted by insurance brokerage affiliates, who may not possess the specialty expertise or technical understanding needed to properly apply models or interpret the results they generate. One notable advantage of early-stage catastrophe studies is to help ensure that the range of insurance costs, which can vary from year to year with market forces, are adequately incorporated into the project financial projections.

The evolving threat of natural disasters

Over the past decade, the financial impact of natural hazard events globally has been almost three trillion dollars. In the U.S. alone, the 10-year average annual cost of natural disaster events exceeding $1 billion increased more than fourfold between the 1980s ($18.4 billion) and the 2010s ($84.5 billion).

Investors, insurers, and financiers of renewable projects have taken notice of this trend, and are subsequently adapting their behavior and standards accordingly. In the solar market, for example, insurance premiums increased roughly four-fold from 2019 to 2021. The impetus for this increase can largely be traced back to a severe storm in Texas in 2019, which resulted in an $80 million loss on 13,000 solar panels that were damaged by hail.

The event awakened the industry to the hazards severe storms present, particularly when it comes to large-scale solar arrays. Since then, the impact of convective weather on existing and planned installations has been more thoroughly evaluated during the underwriting process. However, far less attention has been given to the potential for other natural disasters; events like floods and earthquakes have not yet resulted in large losses and/or claims on renewable projects (including wind farms). The extraordinary and widespread effect of the recent Canadian wildfires may alter this behavior moving forward.

A thorough assessment, starting with a CAT study, is key to quantifying the probability of their occurrence — and estimating potential losses — so that appropriate measures can be taken to mitigate risk.

All models are not created equal

Industrywide, certain misconceptions persist around the use of CAT models to estimate losses from an extreme weather event or natural disaster.

Often, the perception is that risk assessors only need a handful of model inputs to arrive at an accurate figure, with the geographic location being the most important variable. While it’s true that many practitioners running models will pre-specify certain project characteristics regardless of the asset’s design (for example, the use of steel moment frames without trackers for all solar arrays in a given region or state), failure to account for even minor details can lead to loss estimates that are off by multiple orders of magnitude.

The evaluation process has recently become even more complex with the addition of battery energy storage. Relative to standalone solar and wind farms, very little real-world experience and data on the impact of extreme weather events has been accrued on these large-scale storage installations. Such projects require an even greater level of granularity to help ensure that all risks are identified and addressed.

Even when the most advanced modeling software tools are used (which allow for thousands of lines of inputs), there is still a great deal that is subject to interpretation. If the practitioner does not possess the expertise or technical ability needed to understand the model, the margin for error can increase substantially. Ultimately, this can lead to overpaying for insurance. Worse, you may end up with a policy with insufficient coverage. In both cases, the profitability of the asset is impacted.

Supplementing CAT studies

In certain instances, it may be necessary to supplement CAT models with an even more detailed analysis of the individual property, equipment, policies, and procedures. In this way, an unbundled risk assessment can be developed that is tailored to the project. Supplemental information (site-specific wind speed studies and hydrological studies, structural assessment, flood maps, etc.) can be considered to adjust vulnerability models.

This provides an added layer of assurance that goes beyond the pre-defined asset descriptions in the software used by traditional studies or assessments. By leveraging expert elicitations, onsite investigations, and rigorous engineering-based methods, it is possible to discretely evaluate asset-specific components as part of the typical financial loss estimate study: this includes Normal Expected Loss (NEL), also known as Scenario Expected Loss (SEL); Probable Maximum Loss (PML), also known as Scenario Upper Loss (SUL); and Probabilistic Loss (PL).

Understanding the specific vulnerabilities and consequences can afford project stakeholders unique insights into quantifying and prioritizing risks, as well as identifying proper mitigation recommendations.

Every project is unique

The increasing frequency and severity of natural disasters and extreme weather events globally is placing an added burden on the renewable industry, especially when it comes to project risk assessment and mitigation. Insurers have signaled that insurance may no longer be the main basis for transferring risk; traditional risk management, as well as site and technology selection, must be considered by developers, purchasers, and financiers.

As one of the first steps in understanding exposure and the potential capital loss from a given event, CAT studies are becoming an increasingly important piece of the risk management puzzle. Developers should treat them as such by engaging early in the project lifecycle with an independent third-party practitioner with the specialty knowledge, tools, and expertise to properly interpret models and quantify risk.

Hazards and potential losses can vary significantly depending on the project design and the specific location. Every asset should be evaluated rigorously and thoroughly to minimize the margin for error, and maximize profitability over its life.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

ABS Group | www.abs-group.com

Throughout my life and career as a real estate developer in New York City, I’ve had many successes. In what is clearly one of my most unusual development projects in a long career filled with them, I initiated the building of a solar farm to help t....

I’m just going to say it, BIPV is dumb. Hear me out…. Solar is the most affordable form of energy that has ever existed on the planet, but only because the industry has been working towards it for the past 15 years. Governments,....

Heat waves encircled much of the earth last year, pushing temperatures to their highest in recorded history. The water around Florida was “hot-tub hot” — topping 101° and bleaching and killing coral in waters around the peninsula. Phoenix had ....

Wind turbines play a pivotal role in the global transition to sustainable energy sources. However, the harsh environmental conditions in which wind turbines operate, such as extreme temperatures, high humidity, and exposure to various contaminants, p....

Wind energy remains the leading non-hydro renewable technology, and one of the fastest-growing of all power generation technologies. The key to making wind even more competitive is maximizing energy production and efficiently maintaining the assets. ....

The allure of wind turbines is undeniable. For those fortunate enough to visit these engineering marvels, it’s an experience filled with awe and learning. However, the magnificence of these structures comes with inherent risks, making safety an abs....

Battery energy storage is a critical technology to reducing our dependence on fossil fuels and build a low carbon future. Renewable energy generation is fundamentally different from traditional fossil fuel energy generation in that energy cannot be p....

Not enough people know that hydrogen fuel cells are a zero-emission energy technology. Even fewer know water vapor's outsized role in electrochemical processes and reactions. Producing electricity through a clean electrochemical process with water....

In the ever-evolving landscape of sustainable transportation, a ground-breaking shift is here: 2024 ushers in a revolutionary change in Electric Vehicle (EV) tax credits in the United States. Under the Inflation Reduction Act (IRA), a transforma....

Now more than ever, it would be difficult to overstate the importance of the renewable energy industry. Indeed, it seems that few other industries depend as heavily on constant and rapid innovation. This industry, however, is somewhat unique in its e....

University of Toronto’s latest student residence welcomes the future of living with spaces that are warmed by laptops and shower water. In September 2023, one of North America’s largest residential passive homes, Harmony Commons, located....

For decades, demand response (DR) has proven a tried-and-true conservation tactic to mitigate energy usage during peak demand hours. Historically, those peak demand hours were relatively predictable, with increases in demand paralleling commuter and ....